A4

years (divided by 12 months/year) "/>

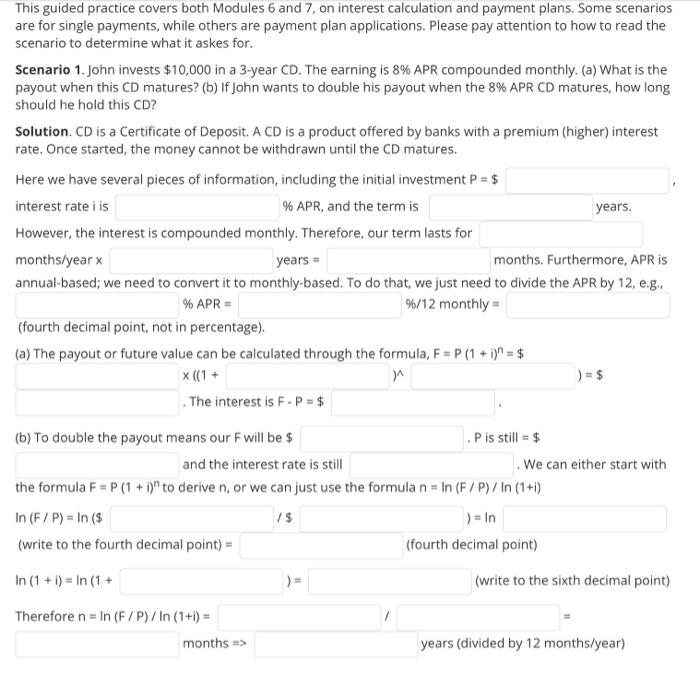

Extracted text: This guided practice covers both Modules 6 and 7, on interest calculation and payment plans. Some scenarios are for single payments, while others are payment plan applications. Please pay attention to how to read the scenario to determine what it askes for. Scenario 1. John invests $10,000 in a 3-year CD. The earning is 8% APR compounded monthly. (a) What is the payout when this CD matures? (b) If John wants to double his payout when the 8% APR CD matures, how long should he hold this CD? Solution. CD is a Certificate of Deposit. A CD is a product offered by banks with a premium (higher) interest rate. Once started, the money cannot be withdrawn until the CD matures. Here we have several pieces of information, including the initial investment P = $ interest rate i is % APR, and the term is years. However, the interest is compounded monthly. Therefore, our term lasts for months/year x years = months. Furthermore, APR is annual-based; we need to convert it to monthly-based. To do that, we just need to divide the APR by 12, e.g., % APR = %/12 monthly= (fourth decimal point, not in percentage). (a) The payout or future value can be calculated through the formula, F = P (1 + i)n = $ x ((1 + ) = $ . The interest is F - P = $ (b) To double the payout means our F will be $ P is still = $ and the interest rate is still We can either start with the formula F = P (1 + i)" to derive n, or we can just use the formula n = In (F/ P)/ In (1+i) In (F/ P) In ($ )=In (write to the fourth decimal point) = (fourth decimal point) In (1 + i) = In (1 + (write to the sixth decimal point) Therefore n = In (F / P)/In (1+i) = months => years (divided by 12 months/year)

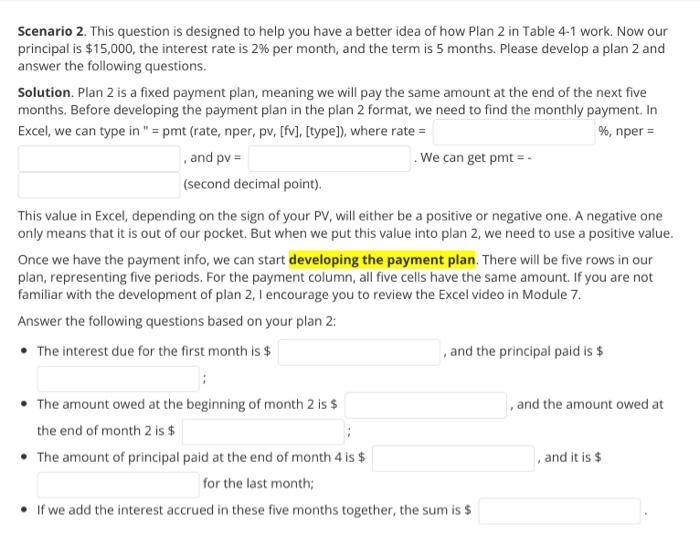

Extracted text: Scenario 2. This question is designed to help you have a better idea of how Plan 2 in Table 4-1 work. Now our principal is $15,000, the interest rate is 2% per month, and the term is 5 months. Please develop a plan 2 and answer the following questions. Solution. Plan 2 is a fixed payment plan, meaning we will pay the same amount at the end of the next five months. Before developing the payment plan in the plan 2 format, we need to find the monthly payment. In Excel, we can type in " = pmt (rate, nper, pv, [fv], [type]), where rate = %, nper = , and pv = .We can get pmt = . (second decimal point). This value in Excel, depending on the sign of your PV, will either be a positive or negative one. A negative one only means that it is out of our pocket. But when we put this value into plan 2, we need to use a positive value. Once we have the payment info, we can start developing the payment plan. There will be five rows in our plan, representing five periods. For the payment column, all five cells have the same amount. If you are not familiar with the development of plan 2, I encourage you to review the Excel video in Module 7. Answer the following questions based on your plan 2: • The interest due for the first month is $ , and the principal paid is $ • The amount owed at the beginning of month 2 is $ , and the amount owed at the end of month 2 is $ • The amount of principal paid at the end of month 4 is $ and it is $ for the last month; • If we add the interest accrued in these five months together, the sum is $